Avoid your inquiry is delay response, please enter your WhatsApp/Skype along with the message, so we can contact you at the very first time.

We will reply you within 24 hours. If for urgent case, please add WhatsApp/WeChat: ,. Or call directly.

Finding the correct HS code for labeling machines can be confusing. Incorrect classification often leads to shipment delays, fines, and problems with customs clearance.

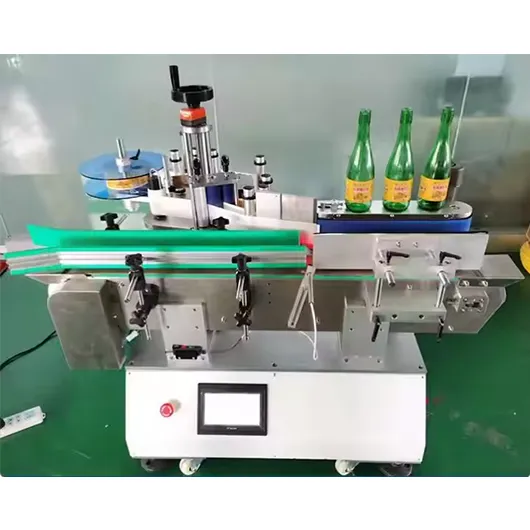

The most commonly used HS code for labeling machines is 84223090. It covers machines designed to label bottles, containers, boxes, and similar packaging automatically or semi-automatically.

Knowing the correct HS code makes customs clearance quicker, helps avoid unnecessary delays, and ensures accurate duty payments. Let’s dig deeper into how you can identify and use the correct HS code for labeling equipment.

When I first started importing labeling machines, I struggled to find the right HS code. Mistakes in coding led to my shipments being stuck at customs more than once.

To find the correct HS code for labeling machines, use customs databases, official tariff schedules, or consult with customs brokers who specialize in packaging machinery.

Here’s the exact method I use whenever I’m classifying labeling equipment:

| Step | Action | Details |

|---|---|---|

| 1 | Identify machine type | Clearly note if your machine is fully automatic or semi-automatic, and intended use (labeling bottles, boxes, etc.). |

| 2 | Access tariff database1 | Use official databases (like the WTO tariff database or US Harmonized Tariff Schedule) to look up equipment descriptions. |

| 3 | Confirm with a broker | Once you find a potential code, always double-check with a customs broker or import/export expert. |

| 4 | Cross-check with suppliers | Reliable suppliers often provide HS codes on invoices or product sheets. Confirm with them to avoid discrepancies. |

When I adopted this structured method, my imports moved smoothly, and I spent far less time dealing with customs inquiries.

Not all labeling machines fall under a single HS code. When I first began importing equipment, I wrongly assumed that all labeling machines shared one code.

Common HS codes for labeling machines include 84223090 for automatic labeling machines, 84224000 for packing or wrapping machinery, and 84433990 for printing and labeling equipment.

This table will help you classify your labeling equipment clearly:

| Labeling Machine Type | Common HS Code | Description |

|---|---|---|

| Automatic Labeling Machines | 84223090 | Automatic labeling equipment, typically for bottles, containers, and packages |

| Wrapping/Strapping & Labeling Equipment | 84224000 | Machines primarily used for wrapping or packing with labeling function included |

| Printing and Labeling Systems | 84433990 | Machines that print labels and apply them simultaneously |

In my experience, labeling machines intended solely for labeling bottles and containers almost always use the 84223090 code. However, complex machines with printing or packaging functions might require another code. Always confirm these details carefully.

Using an incorrect HS code seemed minor to me at first. But when a shipment was detained at customs, I realized just how serious proper classification is.

The right HS code ensures accurate customs duties2, quicker clearance, and compliance with international trade laws, avoiding fines and shipment delays.

Here’s how incorrect classification impacted me, and why I never repeat that mistake:

Delayed Shipments: An incorrect HS code can lead to lengthy inspections. My shipment once got delayed for two weeks, causing a ripple effect on production deadlines.

Increased Costs: Misclassification often incurs penalties or duties recalculated at higher rates. This can erase any profit margin quickly.

Compliance Issues: Consistently incorrect codes attract audits or stricter inspections, complicating future shipments and creating extra paperwork.

| Consequence | Impact |

|---|---|

| Shipment Delay | Missed deadlines, disrupted supply chain |

| Extra Duties and Penalties | Reduced profits, higher costs |

| Compliance Risks | Audits, increased scrutiny, trade restrictions |

After experiencing these issues, I learned the importance of carefully classifying each product correctly every time.

When I started handling international trade, classification was my biggest headache. But now, after years of experience, I’ve learned some valuable tips.

Accurately classify labeling machines3 by clearly identifying their main function, consulting tariff schedules, verifying with customs brokers, and maintaining clear documentation.

Here’s what helped me ensure accurate classification every time:

Always classify the machine based on its primary function. Labeling is clear, but multi-function machines need closer scrutiny.

Rely on official customs databases rather than random online sources. Accuracy is critical, and official databases are most reliable.

I never hesitate to consult a customs broker or freight forwarder familiar with labeling equipment. This reduces my risk of errors dramatically.

Maintain accurate records of classifications, previous customs declarations, and supplier-provided HS codes. These documents help resolve disputes easily.

| Checklist Item | Why It Helps |

|---|---|

| Machine Purpose | Ensures correct primary function |

| Customs Tariff Consultation | Reliable official source |

| Expert Verification | Confirms accuracy |

| Documentation | Provides backup for audits or inquiries |

Since I started using this checklist regularly, my classification process has been error-free, faster, and more efficient overall.

Correct HS code classification is crucial for smooth international trade. Labeling machines commonly fall under HS code 84223090, but always verify carefully to prevent costly errors.

Tariff databases are essential tools for importers. Learn how to effectively use them to find accurate HS codes for your products. ↩

Learn how customs duties are calculated and their impact on your shipping costs and compliance. ↩

Explore this resource to gain insights into the classification of labeling machines, ensuring compliance and accuracy in international trade. ↩